Coinbase Prime provides secure custody companies, letting establishments retailer crypto belongings safely. They present cold storage options, usually thought of the gold commonplace for crypto safety. You can entry a large pool of cryptocurrency for borrowing and lending, which helps with varied funding strategies. This built-in method streamlines operations and simplifies asset administration.

- Following the disaster, however, hedge funds started to pay far more consideration to who held custody of their belongings and their counterparty risk profiles.

- These services embrace dealing with trades, giving stories, and offering operational assist.

- In addition to core lending, prime brokers additionally provide concierge providers.

What’s The Distinction Between A Major Broker And A Custodian?

Prime brokers also provide a spread of further services to help their purchasers’ buying and selling and investment actions. These services include money administration, performance reporting, electronic buying and selling, enterprise consulting, and back-office help. By offering these companies, prime brokers help hedge funds function more effectively and successfully.

Not Like the retail-focused Coinbase and Coinbase Pro, Prime caters to the advanced wants of hedge funds, asset managers, and firms. Prime brokerage began because of the need for better financial providers for managing big portfolios. Now, prime brokerage accounts provide companies like securities lending and leverage trading. Coinbase Prime makes use of good order routing to find one of the best costs on your trades. The system routinely scans multiple exchanges and routes orders to the venue with the most favorable worth.

What’s Coinbase Prime? The Best Institutional Crypto Platform

Prime brokers are important for building sturdy partnerships within the industry. They present tools and sources for protected asset administration and efficient reporting. Their experience in clearing and settlement helps reduce dangers and makes transactions easy. Prime brokers are key for easy trading and investing for hedge funds and big buyers.

It additionally helps giant financial institutions facilitate their businesses and outsource activities that allow them to give attention to their core obligations. For these companies, a major dealer could be a one-stop shop that makes doing enterprise a lot easier. Custodians have turn into more and more pro-active in building providers for hedge fund clients.

It emerged as the prophylactic of alternative amongst hedge fund managers trying to protect themselves in opposition to counterparty risk. That is enticing, within the sense that it replaces Deutsche Bank Securities Inc. counterparty threat with Deutsche Financial Institution AG counterparty danger. However the German bank reckons fund managers and their investors are certain to be much less comfortable with any answer that gives asset segregation inside the identical banking group. “If a shopper is concerned concerning the viability of a monetary institution, they tell us they don’t wish to be in another a half of that very same monetary group and would rather hold the belongings externally” says Byrne. However internal segregation is exactly the choice that well capitalised universal banks corresponding to HSBC, J.P. Morgan and SEB now offer. In reality, in constructing its prime brokerage business HSBC has chosen to use its creditworthiness and custody capabilities as the dual foundations.

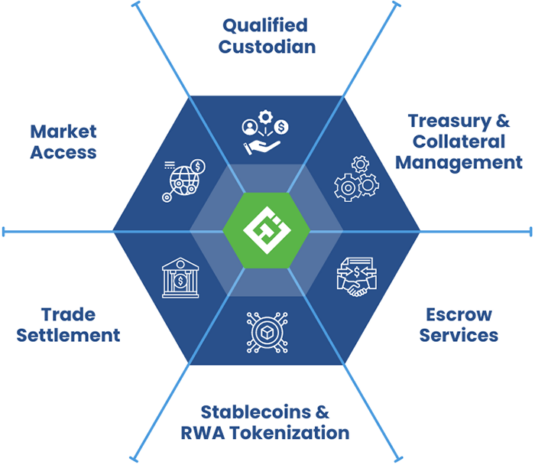

These enhancements respond on to shopper demand for better features and services. Coinbase Prime offers a full-service prime brokerage platform. Its built-in buying and selling, financing, and custody solutions help institutions execute trades and manage assets at scale.

They additionally assist clients use leverage to increase their market publicity. In theory, a custodian bank—or what Individuals nonetheless check with as a belief bank—ostensibly held no customer assets on its steadiness sheet. In theory, trust or custody property were entirely separate from the activities of the bank. Every customer had securities within the digital information of the bank earmarked as their very own. Unfortunately, practice is after all lots fuzzier than that.

A prime broker, as a substitute, is a big institution that provides a mess of providers, from cash administration to securities lending to threat administration for other massive institutions. With the help of prime brokers, these two counterparties allow hedge funds to have interaction in large-scale brief promoting through borrowing shares and bonds from large institutional traders. This permits them to maximise their investments via leverage by obtaining margin financing from industrial banks. They use smart danger administration to guard clients’ investments and cut back the chance of losing cash. Coinbase Prime is tailored for institutional gamers within the crypto house, similar to hedge funds, asset managers, household offices, and companies. These shoppers typically require refined instruments and companies not obtainable on normal retail platforms.

Coinbase Prime doesn’t publicly listing specific buying and selling charges or minimums. They tailor pricing to each institution primarily based on trading quantity. This personalised approach requires direct contact with Coinbase to determine your institution’s price structure. Market situations and regulatory changes can influence these prices. For extra data on market components affecting platforms like Coinbase, try this evaluation on Investing.com.

These providers embrace securities lending, leveraged commerce execution, and threat management, amongst others. Prime brokerage services are essential for hedge funds as a result of they allow these funds to engage in complicated trading strategies that require vital monetary backing and logistical help. What is evident, nonetheless, is that prime custody is right here to remain. The unanswered question is what the evolution of prime custody will do to the industrial economics of the prime brokerage business.

But even if there are operational efficiencies, the service isn’t without value. This was one thing we wanted in our arsenal to make sure clients were comfy with giving us their prime brokerage enterprise.”Another prime broker, Deutsche Bank, has gone down a unique path. It has since 2009 offered purchasers the option to place unencumbered belongings with a 3rd party custodian. While the initial launch focused on European shoppers, the mannequin can be gaining traction in the Usa. The operational burden of shifting and reporting assets is borne by Deutsche Bank, however daily oversight and control is within the palms of the hedge fund manager.

Doing so simplifies reporting and operations for the fund because the prime broker also serves because the custodian for the hedge fund’s property. This additional prime custody streamlines the process of borrowing investment securities and capital since the hedge fund’s assets can shortly and easily be shifted to the prime broker as collateral. Hedge fund assets obtainable for prime custody providers now stand at $684 billion, a 40% improve since 2010, according to a report by BNY Mellon and analysis agency Finadium.