STT OMS supports end-of-day compliance reporting and detailed trade reporting to seamlessly integrate into current back-office processes. Set and update pre-trade risk controls, manage and work together with order move and positions in real-time via both the STT REST API or superior OMS Console. Trusting the system begins with knowing that each one funding knowledge is appropriate as it flows to and from different methods.

As every commerce transaction is logged, the system employs a classy danger management module. This invaluable device allows merchants to proactively halt unprofitable and potentially risky trades. By adhering to well-defined danger management objectives, merchants can maximize income while minimizing losses. An Order Management System (OMS) is a digital system designed to efficiently and economically carry out securities orders. It is usually employed by brokers and dealers to handle orders for several sorts of securities whereas keeping tabs on each order’s status within the system. We firmly believe that non-functional features outline the quality and longevity of the system.

Care Orders

It is supported in all the important thing business objects to ensure correct move segmentation, authorisation and management. The event-driven and transactional nature of the system allows us to capture all the system and enterprise events that improves the transparency. The real-time reporting functionality can be tailor-made to fulfill the specific reporting and compliance requirements. The same OMS should be scalable all the means down to a handful of physical processes running on a single underpowered machine or even a pocket book computer. At its core, our OMS answer follows the micro-kernel design that uses a bespoke messaging framework for inter-process communications (IPC).

The latency launched by the core OMS layer could be configured to be lower than 1µs. A typical configuration of the core OMS process dealing with forty million orders, 20 million amends and 20 hundreds of thousands cancellations would have a reminiscence footprint around 4 to 5Gb. The downward scalability aspect of the system and support for self-contained configurations significantly simplifies the event course of, continuous integration and testing. STT can generate end of day Clearing files based on the specifications of every individual Clearing Firm. Orders that do not cross threat checks are rejected again to trader with straightforward to grasp reject textual content notification.

Traders no longer have to switch between methods or re-key critical data, helping save time and scale back errors. Benefits past the buying and selling desk include improved compliance and auditing, lowered operational threat, and easier infrastructure. Many OMSs offer real-time trading solutions, which permit users to monitor market costs and execute orders in a number of exchanges throughout all markets instantaneously by real-time worth streaming. Some of the benefits that corporations can obtain from an OMS embrace managing orders and asset allocation of portfolios.

Be Up And Operating Rapidly With Managed Oms Trading Integrations

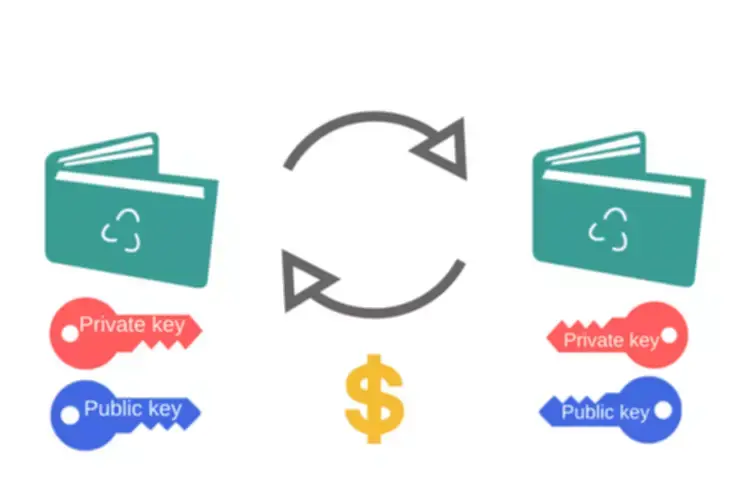

If you wish to dig into order elevating additional, you’ll be able to read more about Limina’s Portfolio monitoring and modelling software program. The OMS Trading Platform is integrated and certified with various entrance workplace buying and selling methods, such as Bloomberg (EMSX, TSOX and FXGO), Virtu and extra, for equities, fixed income and OTC. Typically, only trade members can join directly to an trade, which signifies that a sell-side OMS usually has exchange connectivity, whereas a buy-side OMS is concerned with connecting to sell-side corporations. When an order is executed on the sell-side, the sell-side OMS should then replace its state and ship an execution report to the order’s originating agency.

ZagTrader provides a comprehensive trade order administration resolution that integrates both OMS and EMS functionalities. Their platform offers a unified interface for order creation, modification, and routing, ensuring compliance with regulatory requirements. Together, they form a complete commerce order administration system that streamlines the buying and selling course of from order inception to execution. OMS feeds order data to EMS for efficient commerce execution, and EMS updates the OMS with real-time execution data, guaranteeing accurate order tracking and reporting.

It also integrates with varied trading platforms, exchanges, and liquidity providers, ensuring seamless execution. It connects the customers to various internal and external markets, providing access to the good routing, algorithmic trading, crossing, cross negotiation and different capabilities frequent to fashionable buying and selling platforms. The OMS holds the information of client, care, market-side and custom orders and provides a holistic picture of the present state of the execution move it is deployed to handle. Comprehensive compliance checks make positive that trades adhere to regulatory requirements and inner policies, lowering the danger of violations. Pre-trade compliance needs to be built-in with the order-raising workflows, together with intuitive workflows for viewing rule usage and managing breaches. The OEMS eliminates the a quantity of interfaces, fragmented workflows, and order staging issues inherent in utilizing separate order and execution management platforms.

Custom drop-feed and query components are developed to help real-time long-term knowledge persistence as properly as retrieval. This allows us to attain low latency, low dispersion of latency and high throughput. We believe that a great OMS ought to be capable of handing tons of of tens of millions of orders, amends, cancellations, quotes, and different business objects with out performance deterioration because the capacity increases. The properties required to attain HA are implement from very early levels of the development cycle.

Serving To Fastened Revenue Merchants Maintain Pace With Quickly Altering Markets

As you’ll have an ecosystem of service providers and methods, retaining the autonomy to choose these techniques, information sources, and repair suppliers is significant. We additionally suggest asking the potential vendors to provide reference clients, particularly ones the place they’ve delivered on future requests that had been unknown on the time of contract signing. The reply will present you with a good idea of whether the potential vendor will be ready and agile sufficient to fulfill any future requirements you may not but concentrate on. There are numerous factors to contemplate when choosing a suitable OMS on your agency. For any system procurement, it’s very important to ensure that the answer you select meets your business wants at present and sooner or later. Leverage ADL®, Autospreader®, TT Order Types, dealer algos and third-party algos for superior execution on dozens of colocated exchanges worldwide.

An OMS within the financial markets may be known as a commerce order administration system. In the desk, click on on one of the orders, within the intraday graph, overlay market vwap, your individual fills, and your common price over the day to compare particular person commerce performance in real time. Traders expertise a major increase in profitability once they embrace an order administration system. This powerful device permits them to streamline their operations, effectively lowering operating bills. By swiftly identifying high-performing trades and operations, traders can make informed selections that contribute to elevated profits.

Why Do Companies Need An Oms?

Our research reveals that only one out of every 4 managers belief their portfolio data at present – unbiased of if different systems or Excel is being used. Limina’s OMS System is an agile resolution combining ease of use with the sophistication degree needed by institutional asset managers. While OMS and EMS have distinct functionalities, they often work collectively seamlessly to facilitate the entire commerce lifecycle. OMS focuses on order creation, administration, and compliance, while EMS focuses on trade execution and optimization. Managing threat turns into second nature with the assistance of an order management system.

We avoid rigid order hierarchies and support N levels of order nesting (parent-child relationship). Parent, work/care, market-side or other types orders use the uniform order illustration. Constraints on the depth of nesting, slicing youngster orders, and propagation of trade occasions and states can be imposed on individual branches of the order hierarchy. Sterling’s infrastructure solutions supply international connectivity to a number of exchanges and buying and selling networks together with on demand customized development options.

Key Inquiries To Uncover The Most Effective Oms Buying And Selling System For Your Corporation

The FIX protocol hyperlinks hedge funds and investment firms to hundreds of counterparties around the globe using the OMS. Gain this insight and far more in Allvue’s survey of 114 private capital managers. Intelligent routing algorithms optimize order execution by selecting the right obtainable venues, price over liquidity, and so on., guaranteeing the absolute best execution prices. The danger of loss in online buying and selling of shares, choices, futures, currencies, overseas equities, and glued Income can be substantial. Less than 26µs for 99.5% of messages (including the community hops) for the “business” IPC layer.

The OEMS allows traders to work extra productively concentrating on orders requiring high touch interplay, managing commerce danger, and demonstrating finest execution. Full commerce lifecycle help, built-in compliance and workflow automation enables clients to handle the largest and most complicated institutional portfolios on a single platform. The Charles River Network permits fast and reliable direct entry between buy-side purchasers and sell- aspect brokers. It helps international digital trading via FIX and offers entry to over 700 global liquidity venues.

- Parent, work/care, market-side or other types orders use the uniform order illustration.

- The properties required to achieve HA are implement from very early stages of the event cycle.

- Their platform supplies a unified interface for order creation, modification, and routing, making certain compliance with regulatory requirements.

- It’s important to keep in mind that “time to market” isn’t merely about the preliminary implementation of the system.

- Factors corresponding to scalability, customization choices, connectivity to exchanges and liquidity suppliers, and regulatory compliance must be rigorously evaluated.

With an API method, you possibly can obtain this flexibility with out points around scalability or upgrades typically encountered when using a customized code strategy. A platform’s capacity to integrate with current instruments and processes is the vital thing to lower operational threat and enhance scalability (automation). If the IMS software program can’t provide the integration What is Order Management System in Trading capabilities you need, you’ll wrestle to scale your small business to the desired level. An Order Management System (OMS) is only a tiny part of the total software program capabilities an asset supervisor wants. The chart beneath summarises the capabilities to the left and visualises 6 completely different system landscapes (operating model for investment managers).

Take possession of care orders that your buyer staged and work in accordance with parameters and directions. Control the visibility of customer orders and cross possession to a different user, group or desk.