Thus, it will be possible to judge the provider based on all these factors and decide whether or not it is worthwhile to work with them. In order to allow us to keep developing Myfxbook, please whitelist the site in your ad blocker settings. After that, submit an application and discuss the partnership’s specifics. Basically, the world is heavily dependent on continuous USD supply to facilitate trades, payments, and loans.

Modern technology has simplified processes in many areas of human activity, including market trading. Today, modern software is responsible for creating liquidity; the aggregation process is done automatically and quickly. So, a liquidity aggregator is software that allows brokers to get the necessary bids at the best prices collected from different liquidity providers. The order book is kept by each broker and contains all of their clients’ buy and sell orders. The order book contributes to market liquidity by facilitating for traders the process of identifying trading partners for their transactions.

Financial Adjustments You Can Make Today to Surpass the Market

The volume of a broker’s order book might determine the amount of liquidity available to customers. A bigger order book indicates that there are far more orders to fulfill, which can contribute to improved liquidity, leading to bigger profits for everyone involved. A smaller order book, on the other hand, may make it more difficult for a broker forex liquidity providers to find counterparties for deals. In our forextrading sessions part of the School, we’ll explain how the time of your trades can affect the pair you’re trading. Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary, and does not constitute investment advice.

There is a lot of value in ensuring you get the best deal possible when buying a product. One of the criteria to bear in mind when it comes to finding a good Forex liquidity provider is the pricing of its services. If you are interested in knowing how much the provider charges, you can contact them directly or look up the price on a comparison website.

How FX brokers work – behind the scenes of order execution

In most situations, liquidity providers are regulated and monitored by the relevant state authorities, which check them for compliance with international norms, country laws, and requirements. Every top-notch FX liquidity provider ought to provide fast execution and complete post-trade clarity. The operational process should be thoroughly examined, mainly when new market data is released, and unforeseen situations occur.

Providers of liquidity today are not just the large banks operating in major money center cities, but also online brokers that make markets to retail clients situated all over the world via the Internet. Most online forex brokers and many commercial and investment banks with active foreign exchange divisions are market makers in a variety of currency pairs. In general, a forex market maker will willingly buy forex positions from and sell forex positions to their clients at virtually any time the market is open. The primary liquidity providers in the over the counter Interbank forex market are market makers operating at major commercial banks and some investment banks. The top liquidity providers in the foreign exchange market are known as “Tier 1” liquidity providers. Participants of such trading floors are usually different economic entities geographically located at any point globally.

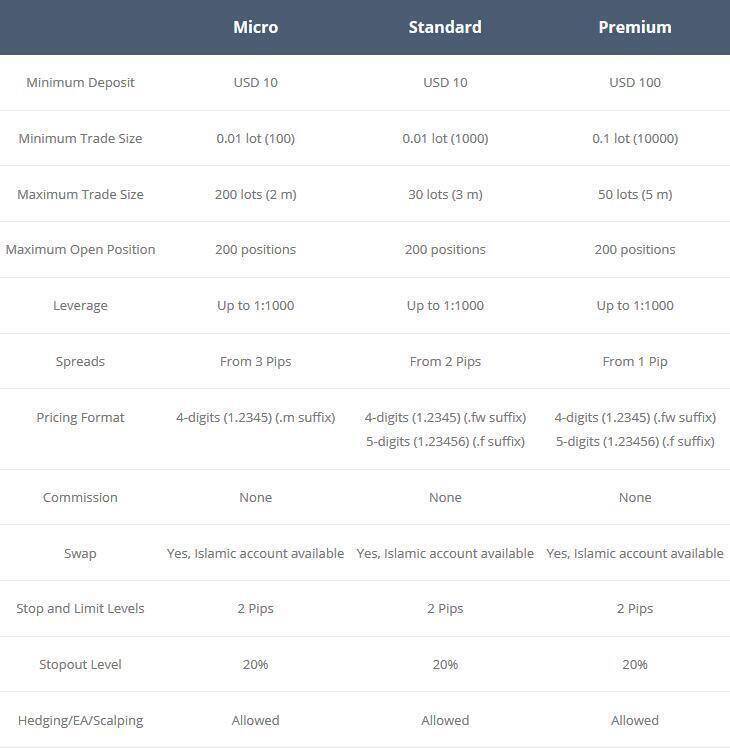

As a broker based on a pure STP model, we can offer you the following conditions

Forex trading involves significant risk of loss and is not suitable for all investors. The U.S. dollar represents about half of international loans and bonds. Because almost every investor, business, and central bank own it, they pay attention to the U.S. dollar. Find the approximate amount of currency units to buy or sell so you can control your maximum risk per position.

The emergence of electronic trading systems made possible the creation of global trading floors, the largest of which today is the Forex market. Pick a trustworthy service among the best and most reliable enterprises provided on the Forex market. A broker’s liquidity can be affected by various factors, which must be taken into account.

How to Print a Booklet for Your Business in 10 Steps

This is a hybrid situation where the broker passes through some transactions, while taking the other side of others. Ultimately, the broker decides which orders should be covered by another liquidity provider and which ones should stay uncovered. Online forex brokers typically access an ECN/STP network to execute their trades. ECN stands for Electronic Communications Network, while STP stands for Straight through Processing. Other brokers operate on an NDD or No dealing desk basis, meaning that all their transactions go directly to a Tier 1 or secondary liquidity provider.

- For STP brokers, much also depends on the type of liquidity provider they use.

- The prices from the various interbank foreign currency markets must be appropriately delivered.

- That is why we have created the Purple Academy where you can find interesting articles, knowledge-expanding ebooks and detailed trading turorials.

- The existence of LP is to create liquidity in the market by generating buying and selling interests allowing market participants to enter/exit their positions resulting in a vibrant market.

- You need to consider your goals and objectives before deciding which one is right for your business.

- Since forex is an ‘over the counter’ market, there is no official data about volume and open interest, so liquidity can be estimated by the number of price ticks and spreads.