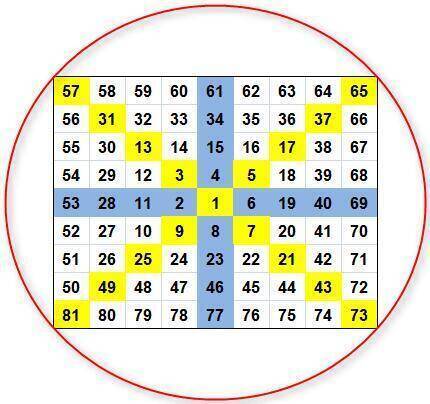

Financial markets are in constant motion, so traders have to analyze data and then use appropriate trading strategies in their work. Gann’s theory has helped many professionals increase revenue. It was developed by William Gann, a trader who lived in the early 20th century. He did not have special education, but with the help of his achievements, he earned $ 50 million. You can read more about this in the Gann Square of Nine articles.

Gann angle 45 degrees – determined using the Gann line

To understand where the price will go, traders use the Gann Indicators angle. With it, you can understand what will happen to the trend over long periods of time. Since it is known that the most persistent gann trend indicator is at an angle of 45 degrees. On large timeframes, the cyclicality is well expressed; therefore, the calculations are accurate.

Gann box: what is it

Gann’s box is part of his system. It can be built manually, but most often, traders use an indicator developed gann indicator mt4. It consists of several simple ones that have been integrated into a single whole and refined to show maximum efficiency gann fan indicator.

Grid

The Gann Indicators grid has the form of intersecting lines plotted on a graph. Although it is assumed that you can build a grid on 2 points, many traders use moving averages with different periods. Their intersections are used to determine the points through which the lines will pass.

William Delbert Gann swing indicator

Translated from English, “swing” means hesitation. Gann understood this as a structure that confirmed a reversal signal. The trader manually drew charts in the form of a “snake,” he used them instead of bars, manually signed prices. In appearance, he determined the direction of the gann trend indicator.

When looking at the “snake,” it is easier to look for levels of resistance and support. In order to make it easier to perceive the chart, at the beginning of the 20th century, it was depicted in different colors, but the distance between the swings was the same.

Gann Indicators identified the following market trends:

- small, 1 bar;

- intermediate, consisting of 2 bars;

- main, of 3 bars.

Now there is no need to draw a chart manually, and traders use gann indicator in their work.

Gann Level Indicator

Gann Indicators levels can be built using the indicator. It will allow you to determine where the levels of support and resistance are on the chart. Using the program makes analyzing the situation on the market easier; the trader spends less time preparing for work.

Gann Hilo or Gann Hilo Activator indicator

These Gann indicators are easy to use; they work based on Gann lines. A trader can change only 1 parameter, indicating the period for the moving average. The line obtained as a result of using the indicator differs from the moving average in that it is more broken. When the market trend changes, the direction of the line also undergoes a change.

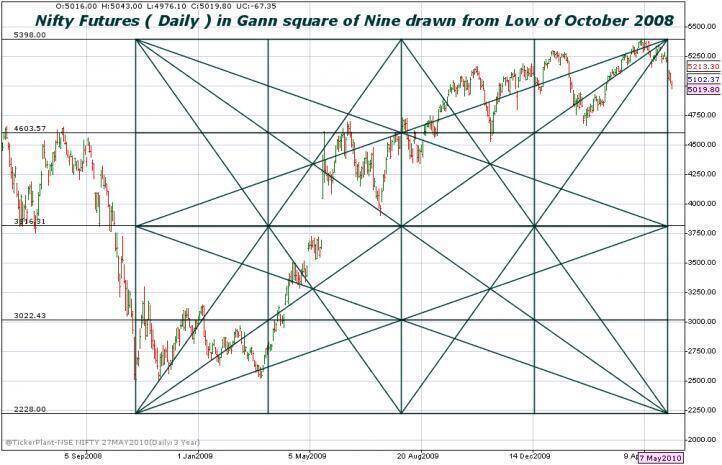

Application of Gann theory in trade

Using the methods of living at the beginning of the XX century. Traders, experts will determine when to enter the transaction, and when to close the order.

The application of theory in trading consists of the following steps:

- First, you need to build a graph that displays the dependence of price and time.

- Identify price fluctuations on it, analyze the values, determine the duration of the rise. Find out when there will be a recession.

- Use the information received in order to make a forecast of where the price will move.

- Build a Gann fan indicator, find out the levels of support and resistance.

- Determine when the correction will begin.