Servicing to a broad range of traders since 2004, Tradeview is an online broker providing traders access to forex and stock markets with multiple trading platforms and streamlined administrative procedures and customer support. Tradeview is a fully regulated broker and has client fund protection schemes.

Know more of what’s in store for traders under Tradeview’s watch by reading this forex broker review.

tradeview 1 1

Tradeview Background & Safety

Founded by Timothy Furey in Grand Cayman back in 2004, Tradeview LTD. started as a small trading firm and grew as one of today’s more popular brokerage sites in the industry. Tradeview provides traders online access, execution of trade, and clearing services to both professional and institutional traders for an array of electronically traded financial products including forex, stocks, options, CFDs, and futures.

Tradeview boasts of giving its clients the latest trading technology (offering four trading platforms), flexibility and personal support with its team of trading professionals, and security of trading funds through its existing policies and measures.

To date, Tradeview claims to have over 20,000 active trading accounts coupled with over a hundred White Labels. It continues to develop its trading conditions by offering ultra-low spreads and flexible commission payouts and leverages. More so, it has complete protection of client funds with segregated accounts at top-tier banks.

In terms of regulatory certifications, Tradeview is a fully licensed Broker/Dealer under the regulations of the Cayman Island Monetary Authority (CIMA). This regulatory body is in the Cayman Islands (a British overseas territory). The islands are known as the fifth-largest banking center in the world. Also, the Cayman Islands ranked 5th with the Financial Action Task Force (FATF), the multilateral institution that establishes the standards for anti-money-laundering.

This kind of regulatory affiliation makes a strong case that Tradeview is a safe turf for traders.

Tradeview Features and Fees

Market Offerings

Tradeview gives traders access to the following financial markets:

- Forex

- Cryptocurrencies

- Indices

- Commodities

- CFDs

tradeview markets en

Account Types

Tradeview offers several accounts to accommodate traders of all skill levels with a full-service forex brokerage. It offers a Demo account for trials and practice of executing trade strategies. For its live accounts, it has the Individual account, Joint account, and Corporate account.

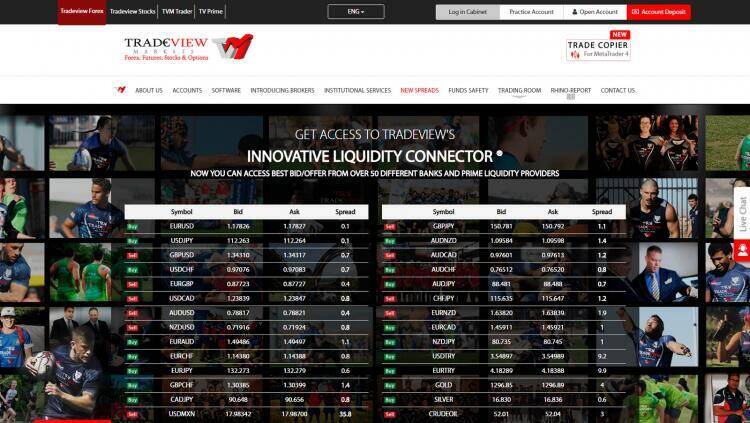

Tradeview’s live accounts are further structured into two types: the Innovative Liquidity Connector and the X Leverage Account.

Here are the conditions under each account type:

Innovative Liquidity Connector – the spreads under this account start from 0 pips and the commission fee is at $2.50 per side. The regular initial deposit required under this account is a hefty $25,000 but it offers a $1,000 account opening until August 31. The maximum leverage is up to 1:100 while the minimum trade size is 0.01 lot.

X Leverage Account – choosing this account type means depositing an initial fund amounting to as low as $100. The spreads featured in this account are floating and competitive. There are no commission fees when trading under this account. The minimum trade size is 0.01 lot while the leverage goes as high as 1:400.

Moreover, these account types provide traders with some other trading features including hedging, auto trading, 5-digit trading, scalping, and access to Individual, Joint, and Corporate accounts.

Funding Methods

Tradeview also employs an array of funding options for its clients. For deposits, traders can choose Bank Wire (GC Partners, Scotiabank, banregio, Banco Pichincha, Fidelity, and Interbank), credit card and e-transfers (Neteller, Skrill, bitwallet, ecoPayz, TroniPay, etc.), and other alternative payment options (STICPAY, bitpay, UPHOLD, Fasapay, etc.). Withdrawal transactions are lodged on Tradeview’s official site through the method of his choice. Deposit and withdrawal transactions are free of charge while third party payments are not permitted.

Tradeview Trading Platforms and Tools

Interestingly enough, Tradeview is among the shortlist of brokerage firms that offer multiple platform options. Tradeview features the industry-popular MetaTrader platforms in MT4 and MT5, CTrader, and Currenex.

MT4

Tradeview’s MT4 platform covers all the standard and basic trading tools and features with an addition of special features and functionality including Expert Advisor, a comprehensive charting package, and multilingual support.

MT5

MetaTrader’s most up-to-date version, MT5, is the advanced version of MT4. Tradeview elevated its MT5 platform offering with a built-in MetaTrader Market, forex signals and copytrading, and strategy tester.

cTrader

cTrader features a set of customizable charts, Level Two pricing, and fast entry and execution. cTrader has the capacity to support multiple order processing that eliminates order queue.

Currenex

Currenex features multiple order types, facilitates execution based on positions, and operates under a reliable technology.

Some other trading tools Tradeview has in its offering include pivots calculator and economic calendar.

Bottom Line

Tradeview is a good option for traders looking for multiple trading platform offerings and tight spreads. However, it needs to widen its currency pairs offering as well as other financial instruments to give traders more options to trade.