FORTSFS is a multi-awarded broker offering forex and other international financial markets. It is known to have market-leading promotions zero margin trading, and zero commission. It also offers a wide range of trading platforms.

Know more about FORTFS and its advantageous trading conditions and services by reading this broker review.

Fort Financial Services broker to avoid web

FORTFS Background & Safety

Founded in 2010, Fort Financial Services Ltd was established to provide services for both beginners and veterans in the trading community. Over the years, FORTFS has worked to expand its range of programs and services, infusing advanced trading order processing algorithms and contracts by partnering with some of the finest liquidity providers.

Aside from its award-winning trading execution program, FORTFS also provides a rich opportunity to its clients to extensively venture the financial markets by establishing trading tools and infrastructures such as regular trading signals, unique analytics, exclusive stock markets reviews and economic news, forex literature, training resources for novice traders, and analytical and practical webinars for all traders.

Talk about its regulatory status, FORTFS is at a disadvantage. The broker is only registered as an International Business Company in St. Vincent & the Grenadines. Aside from this, it has no other regulatory certification from other financial institutions of different jurisdictions.

However, FORTFS continues to uplift its reputation as a good broker. In terms of recognition, the broker has received numerous accolades. FORTFS received its first award in 2014 as The Most Technologically Advanced Broker. It was followed by nabbing the Best ECN/STP Forex Broker citation. The winning tradition continued for FORTFS and its most recent recognition was in 2019, getting the Best Forex Broker distinction by Fxdailyinfo.com.

H2: FORTFS Features & Fees

Financial Instruments

FORTFS offers different asset classes to its clients including forex (140 classic and exotic pairs), Stocks (including USA Blue Chips), Cryptocurrencies, Commodity Futures, and ETFs.

Account Types

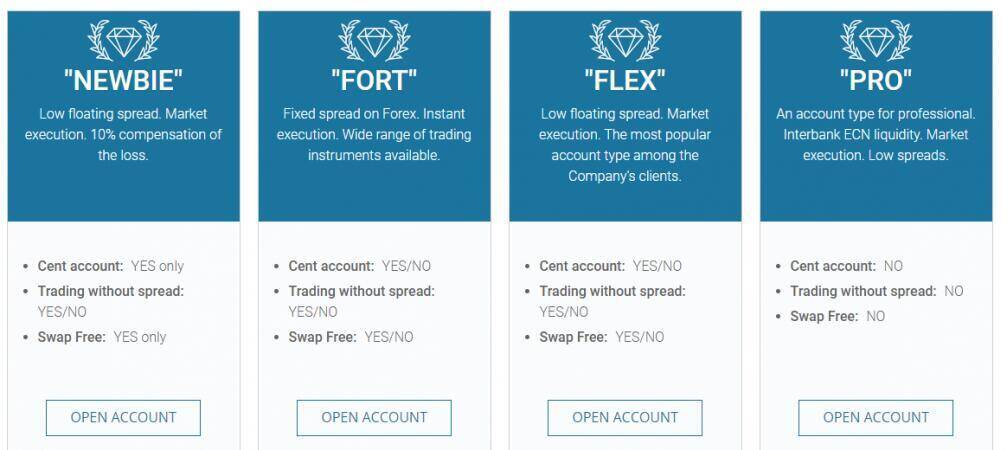

FORTFS offers an array of account offerings to its clients. Here are the trading conditions under each account type.

Newbie – for as low as $5 minimum deposit, you can open this account type that provides you with floating spreads starting from 0.3 pips. The maximum leverage is up to 1:1000 while the commission for CFDs is $10, and zero for forex. The order size is from 0.01 to 10 lots. No deposit bonus and dividends are given for Newbie account users.

Fort – it has the same minimum deposit amount worth $5 and maximum leverage of 1:1000. You are given access to fixed spreads starting from 2.0 pips while it also has zero commission rate for forex trading. What’s different with this account type is the available order size from 0.01-100 lots. Bonus on deposit is also given ranging from 10%-50% while dividends are at 5% and 3% for USD/EUR and USD/EUR Cents respectively.

Flex – it also requires a $5 initial deposit and leverage of up to 1:1000. It parades floating spreads starting from 0.3 pips and zero commission rate for forex trading. The available order size, bonus on deposit, and dividend figures are the same as the Fort account.

Pro – Deposit a minimum amount of $500 to open this account and trade with floating spreads starting from 0.1 pips and leverage of 1:100. The execution speed is 0.1 second, the fastest among all trading account types. Commissions are present in this account as it is set a $9. It offers no bonus on deposit and no dividends to users.

Funding Methods

FORTFS provides several funding methods to its customers in different jurisdictions. Some of the ways to deposit include WebMoney PerfectMoney, Skrill, Kiwi, Neteller, Visa, Mastercard, Fasapay, Indonesian, Malay, Vietnam, and thai local banks, and Mir. WebMoney and PerfectMoney charge deposit fees at 2% and 1% respectively.

The same options are available for withdrawing funds with the same transaction charges.

Promotions

FORTFS is among the few brokers that offer a number of bonuses and programs for clients. They gift Welcome Bonus (35 USD) to clients to experience real market conditions without any financial loss. The broker also gives Deposit Bonus worth 200% for each account user. It also has MEGAPROTECT Bonus that guarantees to protect client funds during drawdowns and gives an additional 100% to the deposit. Other bonuses include Unlimited Leverage and Autorebate.

FortFS Review Trading Account Types

Trading Platforms & Tools

FORTFS provides a set of platform options to traders. It offers MT4, MT5, NinjaTrader, and CQG Trader.

Let us compare these platforms by looking into their features, functionalities, and conditions.

In terms of monthly cost, CQG Trader is edged out as it asks $40 while the other three are free. When it comes to trading contracts available, the MetaTrader platforms have forex CFD. NinjaTrader has Futures while CQG Trader has Futures or Options.

If we put the initial minimum deposit into perspective, the MetaTraders only require a $5 deposit, $15,000 for NinjaTrader, and $10,000 for CQG Trader.

Considering convenience through mobile trading, NinjaTrader is not an option as it has no mobile version. Meanwhile, the MetaTraders are not amenable to a micro-lot account.

What they all have in common are features including advanced testing, chart trading, auto-trading, and Expert Advisors.

Bottom Line

FORTFS is ahead of its competitors when it comes to platform offerings and client promotions. However, the broker needs to fortify its regulatory affiliation and widen its range of asset classes to cater to more traders.