Formerly known as easyForex, easyMarkets reinvented itself to join the upper echelon of the more popular forex brokers online. It started operating back in 2001 in Cyprus. easyMarkets lives up to its name as its trading platform is easy to use backed with several unique offerings. On the flipside, easyMarkets lacks in tradable asset classes and instruments and is sporting inadequate trading tools.

Discover all other important details and offerings easyMarkets has on its site and decide whether or not easyMarkets is worth trying.

bhjмок

easyMarkets Background and Safety

easyForex was a retail forex trading brokerage site for sixteen years starting in 2001. It earned its first certification as a legitimate brokerage site in 2005 with the Australian Securities and Exchange Commission (ASIC). After a couple of years, the Cyprus Securities and Exchange Commission (CySec) awarded its second regulatory certification. Before rebranding, it had its breakthrough year in 2013 after reaching over 100,000 traders that amassed more than $1.5 trillion worth of trading volume.

easyMarkets emerged in 2016 with more diverse trading services capped by new tradable instruments in Commodities and CFD Indices to reach more traders and be a haven to over 300 markets and several instruments.

From its first headquarters in Cyprus, easyMarkets expanded its operation and built offices in Warsaw, Poland as well as in Majuro, Marshall Islands, and in Sydney.

To date, easyMarkets is known across the globe as it has earned numerous distinctions and commendations from the sector and holds a good reputation as a forex brokerage firm. With this in mind, it is easy to say that easyMarkets is a legit and safe broker catering to hundreds of thousands of traders worldwide.

easyMarkets Features and Fees

fgмок

ACCOUNT TYPES

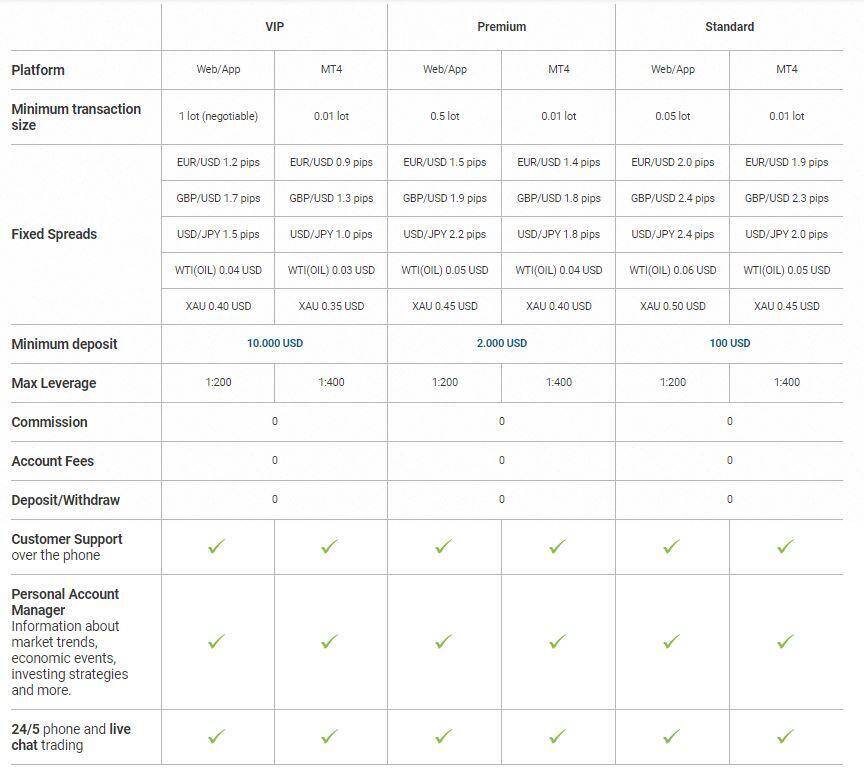

easyMarkets offers three main account types, which are the Standard, Premium, and VIP. Each account type has a set of trading features, trading conditions, and fees. Let’s see each of the account types offered by easyMarkets.

Standard – This account type has a minimum deposit amounting to $100. It has a set of fixed spreads for its featured currency pairs starting from 2.0 pips to 2.4 pips (Web-based platform). This account has no slippage and Guaranteed Stop Loss for its MT4 platform.

Premium – this account requires the user to make an initial deposit worth $2,000. It hosts a fixed spread ranging from 1.5 pips to 2.2. pips for its offered currency pair selection. All the other trading features can be best utilized by choosing its Web-based trading platform.

VIP – this account type is its most expensive among the three account offerings as users need to deposit $10,000 initially. Fixed spreads are ranging from 1.2 pips to 1.7 pips across the currency pairs available.

All the three account types are set with a 1:200 maximum leverage for its Web-based trading platform and 1:400 for its MT4 platform. More so, all account types have access to Customer Support, Personal Account Manager, and weekdays live chat trading.

The trading safety features of all these account types are a disadvantage with the MT4 platform. But account users all receive a daily email of fundamental and technical market analyses to help traders make wise decisions.

Below is the summary of the features of the three trading account types offered by easyMarkets.

Easy Markets

MARKETS

easyMarkets can bring traders to different financial markets including

- Forex

- Shares

- Cryptocurrency

- Metals

- Commodities

- Indices

INSTRUMENTS

It also gives traders different ways to trade using the following instruments:

- Contract for Difference (CFD)

- Options

- Forwards

DEPOSIT & WITHDRAWAL

easyMarkets also made it easy for its clients to deposit and withdraw their funds from their accounts by providing numerous means to do so. Clients can transact via Credit and Debit cards, online banking, wire transfer, and e-wallets.

Depending on the method, the deposit processing time also varies. The great news is that whatever method clients use to transact, it is all free of charge.

easyMarkets Trading Platforms and Tools

easyTrade Platform

easyMarkets has two platform offerings for its users in its Web-based/App platform and the MetaTrader 4.

The easyTrade app, the broker’s own platform features market news, indicators, and charts, among others. This trading platform is very easy to use and is relatively lighter than the MT4.

Its unique features include the dealCancellation, Inside Viewer, and Freeze Rate. The dealCancellation feature is one of a kind trading tool as it gives the trader a chance to undo a trading order within an hour in exchange for a certain fee.

The Inside Viewer tool will enable easyMarket traders to gain a good understanding of market sentiment by learning the percentage of traders who buy and sell.

The Freeze Rate tool is a great opportunity for traders to freeze or pause a certain rate and trade at it.

MT4 Platform

The MT4 platform is advantageous for traders in the aspect of trading information and tools to utilize during trading. However, certain tools and functionalities uniquely offered by easyMarkets are not available on this platform.

Mobile Apps

The easyMarkets App is downloadable in both Android and iOS devices. This app is as simple as the web-based easyTrade platform and possesses the same features.

Bottom Line

easyMarkets, being a multi-asset brokerage site, is a good choice for novice traders. Its user-friendly web-based platform will give them ease in navigating the trade market. It also gives a breath of fresh air for users who have been used to the MT4 platform.

Considering the spread offerings of easyMarkets, it is pricier than the other brokers, but its unique tools will compensate for the expensive trading.