The Moving Average indicator shows traders valuable information on the price changes for stocks, commodities, and other assets. We have spoken about it before in our previous article What is Moving Average indicator.

There are a lot of tactics that use the Moving Average instrument. For example, there are moving average strategies for commodity, stocks, currencies trading. In this article, we shall have a small look at the most profitable moving average forex strategies.

Crossovers Moving Average Strategies

Crossovers strategies are one of the most popular choices among traders. There are two ways of using this technique.

At first, it is the price crossover. As only the prices get higher or lower than a moving average, it is a signal that there is a potential trend change. That is why this tactic refers to the trend following strategies moving average.

Then goes the tactic of applying two MAs to a chart. There should be one long and one short chart average. If the short-term Moving Average gets higher than the long-term MA, this indicates that you should buy because the trend is shifting up. Such a situation is called “the golden cross.”

You can find out more about this and other strategies in our article 3 moving average crossover strategy.

If things are opposite, meaning that the short-term MA has a lower position than the long-term MA, this means that the trend is shifting down and you must sell. Such a situation is called the “death cross.”

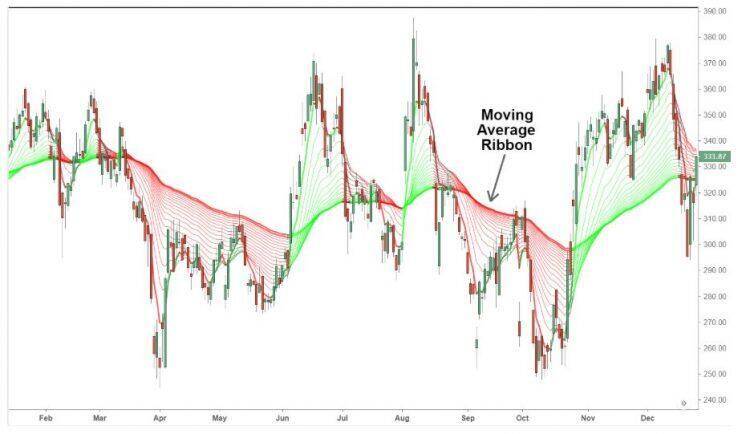

Ribbon Moving Average Strategy

The MA Ribbon strategy is a basic technique that is used with both uptrends and downtrends. This also is one of the moving average strategies that can determine the strength of a trend.

A few EMAs (starting with eight till 15), including short- and long-term ones, are positioned on a chart. We get a ribbon which we get after this shows the direction and strength of a trend. If a ribbon gets wide and there are bigger gaps between moving averages, this means that the trend is strong.

You might notice that the buy and sell signals are the same crossover signals that are present in other moving average strategies. The trader decides himself which many crossovers get the best signals.

Envelopes Moving Average Strategies

MA envelopes are percentage-based and are located over or under an MA. There is no difference in which type of MA is set as the basis; that is why you can use all kinds of moving averages.

A trader can find the best combinations by experimenting with the periods, percentages, and traded currency pairs. Usually, you can find envelopes with a period from 10 to 100 days with a band distance from the MA from 1 to 10% in daily charts. The distance is smaller than 1% when an envelope is used in day trading. You need to change your settings according to the volatility so that the strategy would work.

The perfect way of making profits with envelopes moving average strategies is trading only when the market has a very strong trend. If there is an uptrend, the best decision is buying when the price is near the middle-band moving average and moves away from it. When there is a strong downtrend, you need to pay attention to the price once it gets to the middle-band MA and moves from it. After the short is taking, you need to make a stop-loss order one pip over the fresh-formed swing high. As only a long trade is taken, do the same thing but one pip lower than the newly formed swing low.

Conclusion

There are plenty of tactics that can be described, but we decided to choose the most profitable options for you. You can read our other articles with moving average strategies PDF versions to broaden your understanding of the topic!